WEDDING INSURANCE COVERAGE ANALYSIS

(September 2023)

|

Collapsible Index Wedding/Private Event Cancellation Insurance Property

Coverage Wedding/Private Event Cancellation Insurance Liability

Coverage |

Wedding Insurance is a form of special event coverage. The

trend has, for many years, been that of increasing wedding costs. As of 2022,

average national costs are around $30,000.

Related Article: Weddings and Pandemic Impact

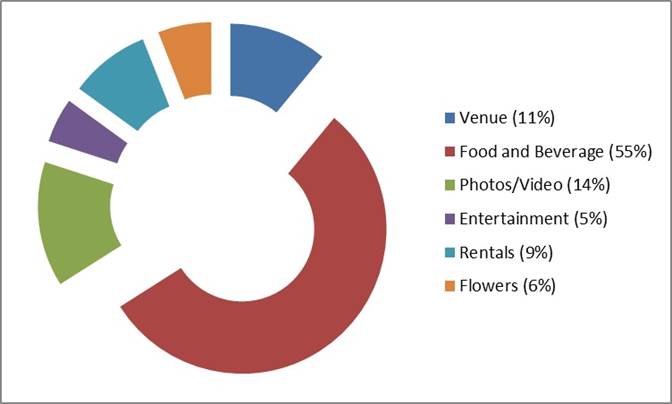

A study from “Bridal Guide” provides the following breakdown

of average wedding costs in the Northeast of the U.S.:

|

|

Wedding insurance is not standardized. Typically, the form

used by the company issuing coverage is a proprietary form. Therefore, it can

be a challenge comparing programs and it would be dangerous to make assumptions

about coverages, conditions, exclusions, etc.

This section is an attempt to discuss items that may be

found in a form offering wedding coverage. It illustrates what may be found

when dealing with this niche market. A comparison chart is available that could

help you in evaluating differences between carriers.

Related article: Wedding Insurance Policy Comparison

Chart

Insuring Agreement

An insuring agreement represents the overarching obligation

of the insurance company issuing the policy, obligating the insurer to respond

to losses that qualify for coverage under the policy. That obligation is

subject to various provisions found in the form. Further, it is subject to the

insured paying the required premium. Also, any coverage hinges upon the

accuracy of the information supplied by insured (via the application).

Typically, information given by an insured is treated as a warranty. Significant

inaccuracies (particularly when intentional) may allow the insurer to void

coverage.

Definitions

Different insurers will use their own set of defined terms.

Below are various terms observed in different policy forms.

Active Participant

Besides the bride and groom, it also refers to persons

attending to the bride and groom (wedding party) and others who play a

significant role in the covered (described) special event.

Bodily injury

Actual or physical harm to a person. Harm includes sickness,

disease, or death (when the death is a consequence of the injury or disease).

|

|

Example: A

wedding guest comes onto the reception dance floor to line dance. She loses

her balance. She stops herself from striking a food table, but not before getting

her face covered in potato salad. The guests laugh and tease her for the rest

of the reception. While the guest is extremely embarrassed and

inconvenienced, she did not suffer bodily injury. |

Declarations

The form lists the insured, the insurer, policy dates, the

subject (event) being covered, the coverage limit, the deductible (if

applicable) and any additional coverages and amounts.

Related Article: Wedding Insurance Coverage

Declarations

Destination Reception

Refers to the celebratory gathering that supplements the

covered event (wedding) but is located at a considerable geographic distance

from the wedding location that may require access via air, boat, or rail

travel. The location usually appears in the declarations and the term typically

includes the distance between the wedding location and the destination

reception.

|

Example: Jodi

and Jersey’s wedding invitation included information on the reception as

well: Scenario 1: Their wedding is to take place in Indianapolis

and the reception is in Fishers, a nearby suburb. This is not a destination

reception Scenario 2: Their wedding is to take place in Indianapolis

and the reception is on a boat on Lake Michigan. This is considered a

destination reception. |

Event

Usually, a broader term for a wedding that includes preceding

and succeeding, related events (rehearsal dinners and receptions).

Event Photographs

Photos of the event that are taken by a professional.

Event Videos

Video footage taken of the event by a professional photographer/videographer.

Being realistic, if no footage was paid for, what loss

has occurred?

Extreme Weather Conditions

Refers to any hazardous climatic event that also includes

the potential for causing widespread damage. Such conditions include floods,

volcanic activity, hurricanes (typhoons and cyclones), blizzards and similar,

major events.

Gifts

Refers to personal property that one party gives to the

persons who are the subjects of the policy coverage. Further, the item given

has to be connected to the special event being insured.

|

Example: Paula, who is engaged and whose special

day is protected by a Wedding Policy, receives an imported espresso machine

that is, shortly afterwards, stolen: Scenario 1: It was taken from

the gift table during her wedding reception – it qualifies as a “gift.” Scenario 2: It was taken from

her kitchen counter during her birthday party that took place two weeks after

the wedding reception – it does NOT qualify as a “gift.” |

|

There are several classes of property

that are specifically excluded as gifts, such as aircraft, motor vehicles

(designed for public road use), cash (and cash equivalents), gold or silver

coinage, tickets, securities, passports, evidences of debt and similar

property.

Honoree

This is the party that is named in

the policy and who is the reason for the special event (wedding). In this case

it should be the bride and the groom.

Leave

Permission given to a bride or groom

to interrupt their military, civil forces, or emergency service duties in order

to participate in the insured, special event.

Medical Expense

The cost of assisting with treating

injuries, including medical/surgical procedures, dentistry, x-rays (likely

would apply to similar, scanning procedures), drugs, prosthetics, glasses,

hearing aids, ambulances, hospitalization, etc.

Nuclear Action

If nuclear reaction,

radiation, or radioactive contamination causes a loss, such loss is ineligible

for coverage, no matter how the nuclear reaction, radiation or radioactive contamination

is caused. Any loss that is a consequence of the above is also not covered.

Fire, explosion, and smoke often are part of a nuclear incident, but even if

these perils are covered under the policy, when they occur as part of a nuclear

reaction, radiation, or radioactive contamination loss, they are not covered.

There is one

exception. If there is a direct loss by fire that is a result of the nuclear

reaction, radiation, or radioactive contamination, it is covered.

Occurrence

Regarding the policy’s property coverage, it refers to

accidental damage or loss to property covered by the policy. With regard to liability

coverage, it refers to an accident which causes bodily injury or property

damage (suffered by third parties).

Note: Continuous or repeated events are treated as a

single occurrence under the liability portion of coverage.

Personal Injury

Harm (not including BI) caused by acts such as (but not limited to) false

(unauthorized) detaining or imprisoning of another party, trespass or unlawful

eviction, malicious prosecution, defamation, libel, slander, invasion of privacy.

Related Court Case: “Personal Injury Liability Coverage Held

Applicable to Claim for Damage to Reputation”

Photographs

Refers to pictures taken at the covered event by a

professional photographer. The term does not apply to footage (moving/serial)

images, regardless who takes them.

Policy Period

The period of time shown as the inception through expiration

dates appearing on the policy’s declarations.

Postponement

A delay in holding the scheduled, covered event.

Pre-existing Condition

This term applies to any medical condition that arises and

has been diagnosed, treated, or had medicine prescribed for it within 12 months

prior to the inception date of the coverage for the described wedding/special

event. It does not apply to conditions that are being treated with medication

and that are considered under control in the one or two months immediately

prior to the date of the event.

Note: This is

regards to key members of the special event whose absence due to a medical

condition would result in the applicable event’s postponement or cancellation.

Private Event

This term applies to the insured event (wedding) and related

activities that occur immediately before and after the event. The event must be

the item described in the declarations. Covered, related, activities include

those that are thrown for the benefit of the “Honoree.” It also applies to

related events thrown for persons who are relatives of the Honoree.

Property damage

Physical injury or destruction of tangible property, or the loss

of use of tangible property, whether or not it is physically damaged (in other

words, theft qualifies as property damage).

Reception

The post wedding event (including next

day breakfast) that is arranged according to the details that appear in the policy’s

schedule or elsewhere in the policy.

Note: This is an

event that is normally within close proximity of the wedding location. If it is

at a distance it is defined as a destination reception.

Rented Property

Personal property that is temporarily acquired to facilitate

throwing the covered, private event. The term only applies to such property

acquired by the insured or the honoree. Items commonly include chairs, tables,

stages, etc. However, certain items do not qualify as rented property, including

special clothing (i.e., tuxedoes, gowns), jewelry, precious stones, paintings, artwork,

and similar property.

Note: A policy may also exclude any type of rented

property that is either transported in a certain manner, such as by ship or may

exclude items shipped to certain locations, such as areas outside of the

Continental U.S.

Special Attire

Refers to clothing that is acquired (purchased, rented, or

borrowed) specifically for wearing at the insured event. It includes apparel

accessories. Such clothing qualifies for the definition when worn by the

insured, the honoree, and that person’s ceremonial attendants. However, the

term does not apply to watches, jewelry, or gemstones.

War

Besides war, this term includes undeclared wars and civil wars. Warlike

action taken by a military force also falls under this definition. Further, the

discharging of a nuclear war, intentional or accidental, also meets the

definition of war.

We, Us, And Our

The

insurance company providing coverage for the wedding (and

reception).

Wedding

See

Private Event.

Wedding Attire

See

Special Attire.

Wedding Party

Refers

to the bride, best man, flower girls, groom, the bride and groom’s families,

bridesmaids, groomsmen, ushers, maid/matron of honor, and ringbearer.

You and Your

The

person(s) who appear on the declarations as insured(s), typically the bride,

groom, parents, or guardians of either and/or any other individual identified

as the event’s (wedding/reception) organizer.

Note: There’s probably no other type of

coverage where insured status can change so significantly and quickly as

Wedding insurance.

PRIVATE EVENT CANCELLATION

INSURANCE PROPERTY COVERAGE

Coverage

Typically, the policy will respond to loss suffered by the

insured because the insured event (described in the policy) has to be cancelled

or postponed (beyond the event date that also appears in the policy). In order

to qualify for coverage, the described event’s cancellation or delay has to be

caused by an eligible source of loss/disruption. Items covered by the policy are

usually expenses that can’t be recovered (non-refundable). Eligible expenses often

include the following amounts:

- Facility

Rental (church, reception halls, etc.) Costs

- Catering

Costs

- Clothing

Rental Fees

- Photographer

Fees (in some cases, videographer fees may also qualify)

- Hotel

Costs

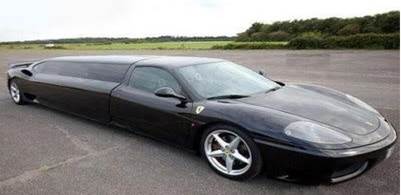

- Transportation

Costs (limos, taxis for transporting wedding party or guests incurred by

insured or honoree)

- Air

Transportation

- Other

miscellaneous, non-refundable costs

|

Example: Regina is to be married in ten days. She

sends her sister to the dress shop to pick up the wedding gowns for the bride

and bridal party. Her sister returns, frantic. She found the dress shop

vacant with an “out of business” sign on the front door. She has no choice

but to postpone the wedding. The refunds and deposits lost due to the

decision are eligible for coverage. |

|

Eligible expenses include those related to the honeymoon as

well as the wedding itself. Other expenses may be the deposits for other

services, such as florists, entertainers, etc. Naturally, payment of these

costs is subject to the policy’s limit.

Note: Some policies

express maximum available coverage as 125% of the original costs of the

applicable services.

Exclusions

Several types of losses do not qualify for coverage.

Usually, a private event/wedding policy will NOT pay for the following:

1. Loss that is due to a set of

circumstances that the insured and/or the honoree were aware of when an

application was submitted.

|

|

Example: The Gentler wedding

party turns in a claim because they have to postpone their wedding for two

months. Their insurer denies the claim. The postponement is due to a delay in

the major renovations of the chapel where the wedding was to take place. The

wedding couple was warned at the time that they set the date that the job may

not be done in time. However, they did not disclose this information to the

insurer. |

2. Loss due to insufficient funds.

Loss caused by the covered parties

lacking sufficient funds to pay for the covered event does not qualify for

protection.

|

Example: Frank

doesn’t know what to tell his fiancée. She was thrilled that they were able

to reserve the Fantasy Hall for their wedding reception. Unfortunately, a

freelance check that Frank was depending on was late and he was not able to

pay the hall’s required final deposit. He not only loses the reservation; the

initial $1,500 deposit is also lost. This is not eligible for reimbursement

under Frank’s wedding insurance policy. |

There is an important exception:

if the reason for insufficient funds is because of an (unanticipated and)

involuntary job loss, coverage still applies.

3. Loss caused by the application of a law or ordinance.

|

Example: Pete and Tessa are holding their

reception. Both are music company executives and, as part of the entertainment,

they arranged for several of their client bands to appear on several temporary

stages. Halfway through the festivities, the police come by and close things

down because of their breaking noise ordinances as well as zoning laws. The

non-refundable expenses due to the close-down are not eligible for coverage. |

|

|

|

Example: Lisay and Niles’ wedding reception was

going extremely well until a group of uniformed persons burst into the

reception areas, destroying the event’s main tent as well as most of their

wedding gifts. Their insurer gives them worse news…they won’t cover the loss.

The uninvited “guests” were police officers. They raided the reception due to

reports of a large supply of illegal fireworks. The evening’s planned

highlight was to be a huge fireworks display. Unknown to anyone connected to

the wedding party, the use of fireworks is banned in the area. The

authorities ended the reception and barricaded it for additional searches.

The loss is ineligible for coverage. |

4. Loss due to strikes or lockouts.

5. Loss due to actions of suppliers.

However, exceptions are made for

failure to perform by persons hired to preside at a ceremony, to provide

facilities, or to provide food/drink IF the insured and honoree have done their

best to find other supply sources.

6. Loss due to Riots or Unrest.

However, there is an exception. If

either the event or the length of the event is affected by civil authorities

blocking access or evacuating the event site, coverage may still apply if the

insured or honoree has made reasonable efforts to find an alternative site.

7. Loss due to Weather Conditions.

This exclusion applies to normal

situations that terminate an event. Coverage still applies to postponement or

cancellation due to the defined, extreme weather conditions.

Note: Adverse or extreme weather conditions refers to events so severe

that they prevent attendance to the special event by

the majority of attendees and/or they damage the event venue(s).

8. Loss due to Failure to Notify.

The policy will NOT reimburse any

deposit, fee or expense created by the honoree’s or covered person’s oversight

to contact a vendor and tell them of the event’s postponement or cancellation.

9. Loss due to an Honoree’s Decision.

When the covered event is

terminated by the honoree, any and all event expenses are no longer eligible for

coverage.

|

Example: Frank and Irmalue

were scheduled to be married on July 6. On July 3, during a crazy-wild

bachelor’s party, Frank’s best friend lets it slip that he was recently

intimate with Irmalue. Enraged, Frank cancels the wedding. The costs that

pile up after the cancellation are not covered by Irmalue’s wedding policy. |

|

10. Loss due to Bodily Injury (Involving Hazardous Activities).

This source of loss that

causes an event cancellation or postponement is not covered if it involves

participation in hazardous activities (such as hunting, skiing, diving,

vehicular racing and similar events), alcoholic beverages, self-inflicted wounds,

military activities, and flying aircraft.

|

Example: The

Adventursums file a claim. They lost all of their deposits because the groom,

three weeks before the wedding, was in an accident. While taking deep sea

scuba lessons, he was attacked by a shark. The recovery will take months.

This loss is excluded. |

11. Loss due to AIDS.

Note: Some forms may

exclude other medical issues, such as sexually transmitted diseases.

12. Loss due to Medical Advice.

Typically, a policy will deny

coverage related to a covered event’s postponement/cancellation when bodily

injury occurs before the event and a medical professional advised against

participation in the covered event.

13. Loss due to Criminal Activity.

An honoree’s or attendant’s arrest

or imprisonment which creates a postponement or cancellation of the covered

event is not eligible for expense reimbursement or loss recovery.

14. Loss due to War and/or Nuclear Activity.

No coverage applies when

a covered event is pre-empted by any military or nuclear activity.

15. Loss due to unavailability of a Wedding Party member caused by

death, dismemberment, illness, injury or quarantine when the unavailability is

due to alcoholic beverage use, drug use, known pre-existing conditions,

pre-event pregnancy (though some policies may amend coverage to reflect this

issue), and self-inflicted injury (including suicide).

Additional Expense Coverage

This coverage is similar to extra expense protection found

in other lines of coverage. Typically, subject to a separate limit, it pays for

added costs that are due to an insured or honoree making alternative arrangements

in order to proceed with the covered event.

|

|

Example: The Chainderwalds’ daughter was scheduled

to have their reception at the town’s luxury hotel ballroom. Three days before

the wedding, the hotel suffers a fire and the ballroom is unavailable due to

damages. Joe Chainderwald scrambles and is able to rent a wedding tent and

the hotel granted permission to use its lawn. However, the tent company,

having to do it as an emergency, also insists on full payment and increased

set-up and breakdown fees. These extra costs are covered by the Chainderwalds’

Wedding Policy Additional Expense Coverage. |

Event Cars and Transportation

This portion of the policy provides a

limited amount of protection for expenses related to a need to arrange for

alternative transportation. The need has to be due to the loss of pre-arranged

(contracted) services from the vehicle supplier or transport service because of

vehicle:

- Accidental

loss (theft, collision, etc.)

- Breakdown

- Unavailability,

but only when circumstances are NOT under the wedding party’s control

|

Example: The

Pledgelys weren’t happy about their reimbursement. They filed a $2,600 claim

due to the cost of their lost airline and hotel reservations. The newlyweds

didn’t make their flight because the only available vehicle from “Haphazard

Limos” was totaled in a crash minutes before it was supposed to take them to

the airport. Having their claim honored didn’t completely make up for their

ruined plans. |

|

Event Cars and Transportation

Exclusions

No coverage is provided when vehicle unavailability does not

involve a pre-arranged service or to loss that occurs

after the wedding, reception or event has been completed.

Gift Coverage

This portion of the policy provides a

limited amount of protection for loss of wedding gifts. The total available

coverage is subject to the property category’s limit and individual gift

sub-limit. Coverage typically applies to any item given to the honoree, related

to celebrating the event. Gifts that are lost, damaged, or destroyed are settled

on a replacement cost basis (no consideration of depreciation). The gifts must

be located in the policy’s stated coverage territory and, if the item cannot be

replaced through practical means, settlement may occur by securing an item of

comparable kind and quality.

The most that will be paid for any

singular, lost item is ten percent of the limit that appears next to the

selection of Gift coverage.

|

Example: Gary’s Wedding

Insurance Policy had the following coverage: |

|

|

|

Gift

Coverage Limit in Declarations |

Individual

Gift Coverage Limit |

|

|

$5,700 |

$570 |

|

|

$22,500 |

$2,250 |

|

|

$13,000 |

$1,300 |

|

Gift Coverage Exclusions

This coverage part does not apply to

losses involving ordinary wear/tear, action of insects/vermin, inherent vice,

temperature/humidity/extremes, or gradual deterioration.

When the damaged or lost property

qualifies as fine art, there is no coverage when the loss/damage is the result

of efforts to repair or restore

the property. For all other property, no coverage applies when loss/damage

occurs while the property is being repaired,

serviced, or maintained. Typically, there is an exception when the loss

is due to fire or explosion.

|

Example: As a

wedding gift, Lily’s grandmother gives her a valuable piece of sculpture. She

takes the piece to a college friend who is getting a degree in art curation. The

college friend, in an attempt to clean the piece, leaves a cleaning solution

on that was improperly mixed and it ends up corroding and ruining it. This

loss is ineligible for coverage under Lily’s wedding insurance policy. |

When the property consists of

statuary, marble, porcelain, glass, china, furniture and similar, fragile

items, there is no coverage for loss or damage resulting from scratching,

marring or breakage. However, such losses are covered if caused by the

following:

·

Aircraft, self-propelled missiles, falling objects

·

Building collapse

·

Earthquake

·

Flood

·

Fire (including smoke) or explosion

·

Lightning, wind, or hailstorms

·

Sprinkler damage (leaks)

·

Strikes, riots or civil disturbance

·

Theft

·

Vehicles

Other sources of loss or damage to

gifts that are ineligible for coverage include electrical currents (exception

for lightning or resulting fire), mechanical breakdown, theft from an unattended

(unlocked) vehicle, nuclear activity, or war.

Jewelry Coverage

This coverage (when a limit appears

for it on the declarations) covers jewelry acquired for the covered event and

which is worn by the insured and/or the honoree. Naturally, such coverage is

subject to the stated limit and applies to jewelry that the covered parties

either own or which is rented for the covered event.

|

|

Example: Joshua and Typhania

file a claim with their wedding insurer. An emerald necklace was stolen from

Typhania when she left the bride’s dressing room for a few minutes. The

insurer declines the loss when they discover the brooch was borrowed from a

friend to wear at a parent’s anniversary party that took place two months

earlier. |

Losses are settled on a replacement

cost basis and the maximum payment is subject both to the value of the lost or

damaged property and the applicable insurance limit (whichever is the lower

amount). When damage or loss occurs to a piece of property that is part of a

pair or set, the insurer has the option to settle according to the property’s

pre-loss value, but the surviving property has to be surrendered to the

insurer.

Jewelry Exclusions

Sources of loss or damage to jewelry

that are not covered include theft from an unattended (unlocked) vehicle, wear

and tear, gradual deterioration/inherent vice, nuclear activity, or war.

Photographs and Video

Recording Coverage

This portion of the policy provides a limited amount of

protection for loss of wedding pictures and video footage. However, the

coverage only applies to photos and footage taken by professionals. Amateur

shots and videos do not qualify for protection. The available coverage is

subject to the insurance limit that appears on the policy’s declarations. In

the event of a number of circumstances, this coverage will pay to have pictures

or videos made of the special event. Coverage applies in the following instances:

- The photographer

or videographer does not show up to the event

- The

original tape or footage fails to develop, is damaged or destroyed

- The

original tape or footage is damaged or destroyed

Expenses eligible for coverage/reimburse include the cost to

rent the facility (as a setting) transportation, meal and lodging costs for

honorees, attendants and immediate family, cost to rent gowns, dresses,

tuxedos, reimbursement mileage for persons driving back for replacement

photo/video session, cost to buy or rent cake and flowers to re-stage the

event, costs to re-hire a photographer or videographer.

Note: Travel, meal and lodging costs are stated on a

per person basis.

|

|

||

|

Example: Andy and Paula’s

wedding photographer calls several days after the wedding. He was in an auto accident

on the way back from their wedding and all of the pictures he took there were

destroyed. The couple rushes to gather everyone again to re-stage the wedding

in order to get new photos and film. The wedding policy purchased by Paula’s

parents listed the following (the column next to the limits are the actual

re-staging expenses): |

||

|

Photographs

and Video Tape Coverage |

||

|

Coverage |

Limit |

Actual

Loss |

|

Total Coverage Limit |

$15,000 |

$20,800 |

|

Special Attire Limit |

$300 per person/$5,000 max. |

Avg. $330 per person/$6,600 |

|

Meal/Lodging Limit |

$250 per person |

Avg. $210 per person/$5,200 |

|

Mileage/Travel Reimbursement |

.045 per mile/$500 per person max |

Avg. $375 per person/$9,000 |

|

Totals |

|

$15,000 Reimbursed |

|

In this case, the photo coverage

helped immensely, but Paula’s parents still suffered a large expense ($20,800

- $15,000 = $5,800) due to the policy’s sublimits and having a large number

of event participants who were at remote locations. |

||

Exclusions – Generally, the

coverage will not apply when photo and/or video loss is due to nuclear or

military activity, moisture/rot/mold, insects/animals/bugs, normal wear/tear,

confiscation of property or (for videos) when the audio quality is sub-standard.

Note: This coverage only

applies to pictures and footage taken by professionals. Loss of amateur

photography or footage (even if it is the only source of visual documentation

of the event) is NOT eligible for protection.

Rented Property Coverage

This portion of the policy provides a

limited amount of protection for loss of property that is rented by the insured

or the honoree when such property is in those parties’ care, custody, or control.

Further, the property must be related to facilitating the covered event. The

maximum coverage (either replacement or repair) for a single item of

high-valued property is $1,000. To qualify for additional coverage, such

high-priced items must be specifically described (scheduled) under this

coverage. Such items must also be accompanied by an assigned value.

Rented Property Exclusions

Sources of loss or damage to rented

property that are not covered include mechanical or electrical breakdown, theft

from an unattended (unlocked) vehicle, wear and tear, gradual deterioration/inherent

vice, third party loss of income, dish4onest acts (by insured or honoree),

mysterious disappearance, insured’s neglect, nuclear activity or war.

Note: For breakdown-related

losses, there is coverage if subsequent fire or explosion damage occurs.

Special Attire Coverage

This coverage responds to loss or

damage to clothing that the honoree and attendants acquire for wearing at the

covered event. Settlement is based on replacement cost of the property and, if

the same property is unavailable, the insurer can fulfill its obligation by

finding similar, comparable property.

|

Example: Suellen

has a wedding policy which includes Special Attire coverage for $5,000. She

asks her kid brother to go pick up her bridal gown from a dressmaker. Her brother

does so, reluctantly. When he pulls into the driveway, he notices Suellen

screaming and then fainting. When he gets out of the car, he sees that half

of the gown had been hanging out of the door and was destroyed. The

dressmaker says that the dress was a custom design that she can’t replace in

time for the wedding that was to take place in a week. However, she does have

a similar design that she can alter for $3,900. Suellen’s policy will handle this

loss. |

Special Attire Exclusions

Sources of loss or damage to special

attire that are not covered include theft from an unattended (unlocked)

vehicle, wear and tear, gradual deterioration/inherent vice, nuclear activity,

or war.

Limits of Insurance

The policy states that all payments

that qualify under the policy are subject to the applicable limits and, for a

given occurrence, the payment maximum is not affected by the fact that more

than one claimant, insured, losses or lawsuits are involved. Further, if

applicable, the losses paid under the policy during the stated policy period

are subject to the policy’s aggregate limit.

Deductible

As applicable, loss payments are all

subject to any deductible that appears under any separate coverage provided by

the policy. If only one deductible is listed, that amount applies to payments

made separately under any applicable coverage.

When a coverage is subject to a

deductible that deductible is entered on the Declarations. Any applicable

deductible applies per occurrence. When multiple coverages apply to a single

event, all applicable deductibles also apply that event. Some policies may provide

a single occurrence deductible or a maximum occurrence deductible when multiple

coverages apply to a given postponement or cancellation.

Loss Conditions

The policy obligates the insured/honoree

to a number of conditions in order to handle an eligible loss. As is the case

with other lines of business, a failure to comply with requirements could

endanger the insured/honoree’s right to recovery. Typically, the

insured/honoree has to do the following:

1. Notification

and Duties – the insured or honoree must:

·

Quickly notify the insurer and, if appropriate,

legal authorities about a loss

·

Protect property from additional damage or loss

·

Put in a good faith effort to arrange for

alternate sources of goods/services if a provider fails to perform as

contracted

·

Put in a good faith effort to arrange for

alternate sites to host the covered event or related activity

·

Provide the insurer with a sworn loss statement

no later than 60 days from the date of loss, including inventory of property

involved in the claims, copies of documents that substantiate their value and

all relevant details about the loss circumstances

·

Put in a good faith effort to arrange for

alternate special attire to wear at a covered event

·

If bodily injury to a participant triggers a

need to postpone or cancel an event, the injured party must seek qualified

help, must adhere to instructions provided by medical personnel regarding

recuperation from the injury and must agree to the insurer’s reasonable request

to have separate examinations performed

·

If a loss or injury results in a fatality, the

insurer reserves the right to make a post-death examination

2. Loss Payment

This is an insurer

obligation. Once either the insurer has agreed with the applicable party

suffering the loss or an arbitration decision has been made (and filed),

payment must be made within 30 days. The insurer will handle payments according

to the insurable interest that is documented in the policy.

3. Appraisal

If the insurer and the named insured or honoree do not agree over the

value of the covered property or the amount of the loss, each party (after

receiving a written request from the other party) may select an appraiser. The

two appraisers will select an umpire.

If the two appraisers agree in writing, that

sets the amount of the loss. However, if they do not agree, the differences are

submitted to the umpire and then the written agreement of any two of the

parties sets the amount of loss. The decision is binding on all parties. Each

party will pay its appraiser and the two parties will share the cast of the

umpire and related expenses equally.

Note: An appraisal is

about the amount of an eligible loss, not whether or not coverage applies.

Also, there typically is no mention of time limits for completing the appraisal

process.

4. Right to

Settle

When lost or

damaged party involves property that is borrowed or rented from others

(including jewelry), the insurer has the right to settle the loss directly with

the property owner and such payment is deemed to satisfy its obligation to the

insured/honoree.

5. Abandonment

The insurer is not

obligated to accept custody of property that has been abandoned by an insured

or honoree.

PRIVATE EVENT CANCELLATION

INSURANCE LIABILITY COVERAGE

Coverage

Personal Liability

When this coverage applies (as

indicated on the declarations), the insurer has the obligation to protect the

insured against losses or lawsuits that allege that the insured/honoree is

responsible for bodily injury, personal injury or property damage to a third

party. However, any claim must be due to an incident that occurs at the covered

event and within the applicable policy territory. The coverage obligation does

not only apply to losses, but also includes a duty to legally defend an insured/honoree

against claims/losses. Either a settlement or the exhaustion of the applicable

limit ends the insurer’s duty to provide a legal defense.

|

Example: The Brydals are

sued by a best man who was seriously injured when the nervous groom turned abruptly

to get the wedding ring and knocked the best man off a podium. |

|

Related Court Case: Business Pursuits Exclusion

Held Applicable to Wedding Reception Services

Personal Liability Exclusions

This portion of the policy does NOT

respond to losses that involve any of the following:

·

Aircraft, Watercraft or Vehicles (including

allegations of vicarious responsibility)

·

Injury suffered by the insured or honoree

|

Example: The wedding was

beautiful, but the reception left much to be desired. The bride’s parents

were sued by the groom’s best man. The best man attempted to escort a former

boyfriend of the bride (who crashed the event) from the reception. As he did

so, the best man tripped over some cables (used by the wedding band), fell,

and suffered broken facial bones. This was an eligible loss because the

wedding party made no arrangements to guard against crashers and the best man

was not an insured or honoree. |

·

Athletic Activities

|

|

Example: The Brydals are

having a bad day. After returning from their honeymoon, they get a notice of

a lawsuit in their mail. A friend was seriously injured during the pick-up

flag football game that was held during the wedding reception. This loss is

ineligible for coverage. |

·

Liquor Liability - however this only applies

when the insured/honoree are in the business of making, selling, distributing,

or furnishing liquor

·

Other premises than the covered event’s location

(unless the declarations lists the other premises such as a separate reception

location)

·

Nuclear Activity or War

·

Incidents either covered by or eligible for

Workers Compensation Coverage

·

Fines or Penalties

·

Property in the Care, Custody or Control of the

Honoree or Insured

Exceptions for

property damage typically applies to guest property (including their vehicles),

or to property belonging to the premises rented for the covered event. An

exception may also apply to non-owned, parked vehicles for which the honoree or

insured may have a legal obligation.

·

Property that is Sold or Rented by the Honoree or

the Insured, including jewelry, rented property and special attire.

·

Damage or Injury that an Insured/Honoree Expects

or Intends

Note: An

exception is granted for incidents involving protecting oneself, another person

or another person’s property from the deliberate actions of others.

·

False Statements Made with Insured/Honoree’s

Knowledge of Falsity

|

Example: The groom is guilty

of a silly act of revenge during his wedding reception speech. He tells a

former girlfriend and the rest of the attendees that “she probably regrets

that she let him get away because her current husband frequently cheats on

her.” He knows the statement is a lie. When he’s sued, his wedding policy will

not respond to the lawsuit. |

·

Statements Published Prior to the Policy’s

Inception

·

Deliberate Violation of Laws or Statutes

Applies to incidents

involving the insured or the honoree or to incidents done with the knowledge of

the insured or honoree.

Medical Payments to Others

This coverage applies to incidents of

bodily injury that occur to persons other than the insured or the honoree and

if they occur at the covered event. It pays for a wide variety of expenses connected

to treating an injury, such as the cost of providing first aid, x-rays (or other

scanning), transportation by ambulance, and similar expenses. However, besides

occurring at the described event, to qualify for coverage the incident has to

be reported within a year of the accident date and the injured person must

agree to the insurer’s reasonable requests to undergo physical examinations (by

physicians chosen by the insurer).

|

Example: Using a previous scenario shows how valuable Medical

Payments coverage can be. Again, the Brydals are, initially, threatened to be

sued by a best man who was seriously injured when the nervous groom turned

abruptly to get the wedding ring and knocked the best man off a podium. The

Brydals quickly call an ambulance and the best man is quickly and

successfully treated onsite. The best man cools down and does not sue. |

Additional Payments

Typically, related to the policy’s

existing liability coverage, the form may also include the following protection

that does not affect what is available under the stated liability policy limit:

1. Settlement and Defense Costs –

covered expenses include post-judgment interest

2. Appeal and attachment bonds premiums

3. First aid expenses

4. Other reasonable expenses which the

insured or honoree pays at the request of the insurer

5. Loss of earnings due to trial

attendance or participation in other activities at the request of the insurer.

This coverage is limited to a specified, daily maximum that appears in the

policy.

Limits of Insurance

The policy states that all payments

that qualify under the policy (bodily injury, property damage and personal

injury) are subject to the applicable liability limit and, for a given

occurrence, the payment maximum is not affected by the fact that more than one

claimant, insured, losses or lawsuits are involved. Further, any payments made

under the form’s medical payments provision are subject to the separate limit

that appears for that coverage.

Loss Conditions

The policy obligates the

insured/honoree to a number of conditions in order to handle an eligible loss.

As is the case with other lines of business, a failure to comply with

requirements could endanger the insured/honoree’s right to recovery. Typically,

the insured/honoree has to do the following:

·

Quickly notify the insurer in writing about a

loss which includes insured’s and honoree’s address and other identifying

information, complete date, time, location and loss circumstances, names and addresses

of all persons who may have a claim to make against the insured or honoree,

names and addresses of witnesses

·

Immediately forward all paperwork and materials

received in connection with a claim or lawsuit to the insurer

·

Fully cooperate with the insurer with all

matters connected with the claim or lawsuit, including pursuing rights of

recovery against other parties who may bear responsibility for the applicable

loss, attending trials and hearings, collecting evidence, giving testimony and

assisting with the attendance of witnesses

·

When applicable, the insured and involved parties

must agree to contact and cooperate with legal authorities

·

Other than providing first aid, neither the insured

nor the honoree should offer to voluntarily pay for losses claimed by other

parties unless they do so at their own expense

Note:

Insurers frown upon expenses made out-of-pocket by the insured because it could

prejudice the insurer’s right to determine liability (be construed as an

admission of liability).

Conditions

Age and Residency

Coverages under this form are valid only for weddings

involving a bride and groom who are both, at least, 18 years of age and who are

also permanent residents of the

Assignment of Policy

No insured or other party can sign this policy and its

coverages over for use by any other party unless, first, getting the insurance

company’s permission (in writing).

Bankruptcy

Bankruptcy or insolvency of an insured does not relieve the insurance

company of its obligations under this policy.

Cancellation

This policy may be canceled by the insured by returning the

policy to the insurance company or by giving the insurance company written

notice that states at what future date coverage is to stop. However, the cancel

request must occur before the applicable event’s scheduled date and without a

claim having occurred.

The insurance company providing coverage may cancel this

policy by written notice to the insured at the address shown on the

declarations. Proof of delivery or mailing is sufficient proof of notice.

The insurer may only cancel coverage for nonpayment of premium

or due to either the honoree or the insured having concealed or misrepresented

information regarding this coverage.

Important: In

certain instances, parts of this provision may be pre-empted by state law

regarding cancel reasons, amount of notice and proof of delivery.

If any return premium is owed, it will be refunded at the

time of the cancellation or as soon as is practical. Payment of the unearned

premium has no bearing on cancellation.

Note: Return premium may be based on how long the

cancel request precedes the covered event. A short rate return is likely if

requested more than 30 days before the event. No return is likely if the

request is sooner than 30 days before the event.

Concealment or Fraud

Any intentional concealment or misrepresentation on the part

of the insured or the honoree may void the policy’s coverage.

This provision supports the fact that an insurer should be

able to rely on the statements made by the insured (or honoree) in making its

decision to insure a person or property. If the statements are seriously in error,

the insurance contract has no right to exist and the company has no obligation

to honor it.

Conformity to State Statutes

Policy terms that conflict with the laws of the state in

which the event shown on the declarations is located, are changed to conform to

such laws. This provision is rarely relied upon since amendments or

endorsements are added to policies to match the state where the policy is used.

However, there are instances where the condition may be applicable.

Coverage Changes

Only the insurance company has the option of waiving or

changing this policy’s terms. In order for a waiver to be effective, it must be

in writing and attached (endorsed) to the policy.

Legal Action against Us

Neither the insured nor the honoree is permitted to file suit against

the insurer without the amount of the insured’s or honoree’s liability having

been determined by either of the following:

- A final

judgment against the insured as a result of a trial

- A written

agreement between the insured, the claimant, and the insurer.

Note: No person has

a right under this policy to join the insurance company or to speak for the

insurance company in actions related to determining the amount of an insured’s

liability.

Other Insurance

Depending upon the source of coverage that is available (in addition to

this policy), the policy may respond to the loss on either a proportional or an

excess basis.

When there is other insurance that applies to the loss, the insurance

company providing coverage under this form is only obligated to pay its share

of the loss. This policy’s share is based upon the portion of coverage it

provides in relationship to the total amount of coverage available from all

sources of coverage, which apply to the loss.

Records

The insured must support applicable claims with documents, bills of

sales or receipts that help to establish the amount of a claimed, eligible

loss. The insurance company must be provided access to

any, relevant documents.

Transfer of Rights of Recovery against Others to Us

When an insurer pays damages, it may ask the insured and/or the honoree

to transfer his or her right to attempt to recover damages from another party.

The insured must agree to do so and to fully cooperate with the insured in

pursuing the recovery. This act of seeking payment from a party responsible for

a loss is called subrogation. This right is valuable to an insurer. In fact, if

an insured hampers this right to recover payment after a loss has occurred, the

insurer may no longer be obligated to pay for the loss.

Note: Unlike other lines of business, there does not appear to be the usual

option of permitting the insured to seek a written waiver.

The absence of this option appears logical when you consider the typical

number of persons and business entities that may bear significant fault for a

cancelled or ruined event. It is likely a high priority to maximize the ability

to recover amounts from other parties.

Privacy Agreement

Some policies may include a provision concerning protecting

the wedding party’s privacy. Much of the information concerning the policy,

application and claims may be quite sensitive, such as financial agreements and

medical or health information. Under this provision, the insurer agrees to act

in a manner that respects confidentiality with regard to the information it

uses, accesses and, if necessary, discloses to other parties. You may recognize

how this might be particularly important for high-profile weddings.